salt tax cap repeal senate

For tax years beginning on or after January 1 2022 the law requires the credit to be applied against the net tax after. Dec 2 2021.

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

January 28 2021.

. It is important to understand who benefits from the SALT deduction as it currently exists and who would benefit from the deduction if the SALT cap were repealed. And lets not forget the repeal of the cap is their ultimate goal. Democrats are eyeing repealing the Trump-era 10000 cap.

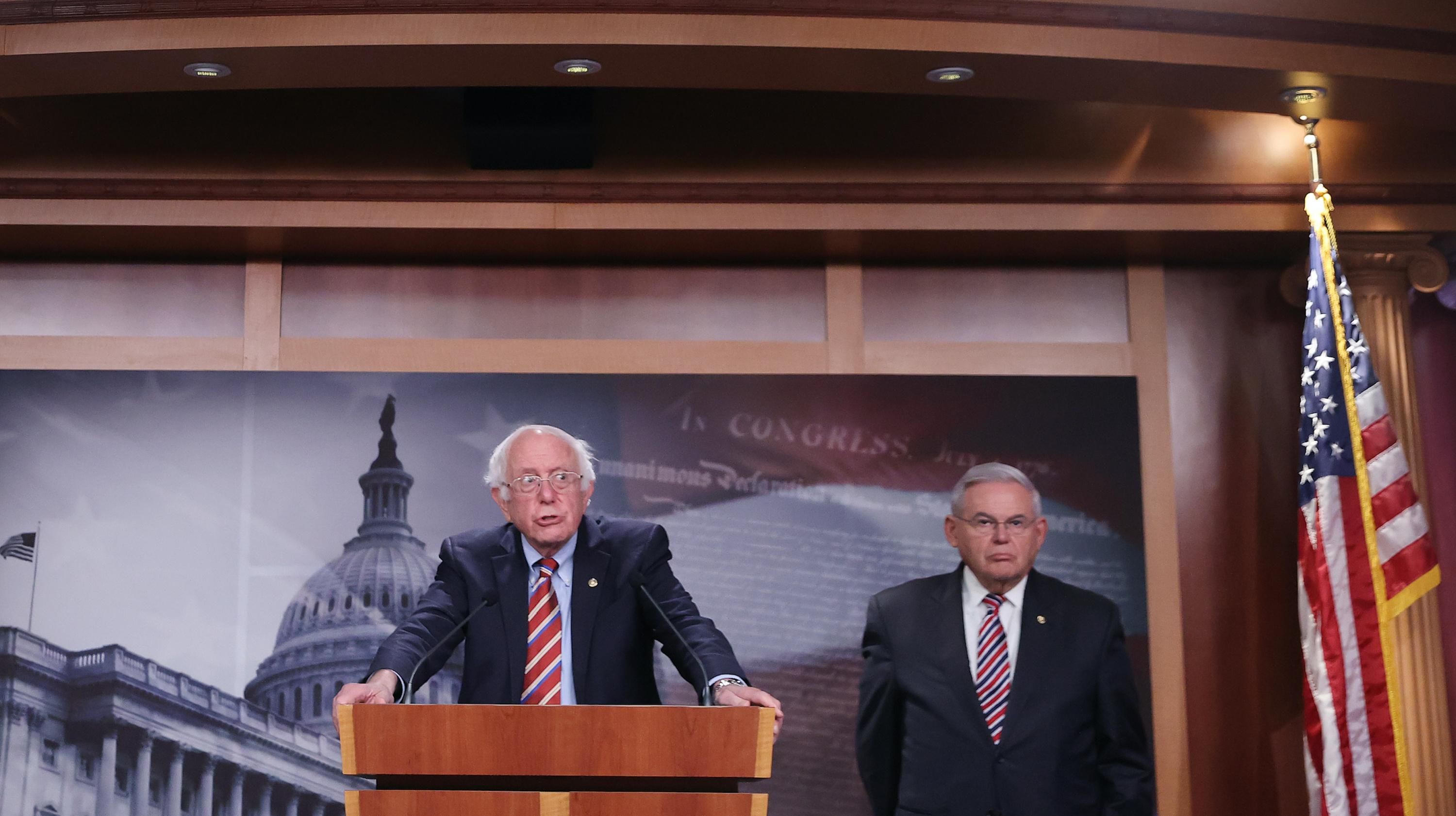

The TCJA reduced the corporate tax rate from. Americans who rely on the state and local tax SALT deduction at. Meanwhile Senate Democrats led by Bernie Sanders of Vermont and Bob Menendez of New Jersey are angling to cap the tax break by income making it unlimited for individuals earning about.

As you can see the majority of the benefit from repealing the SALT cap 52 percent would flow to taxpayers with incomes exceeding 1 million. In this case revenue neutrality is simply a budget. This would be in place of the House plan to lift the cap to 80000 through 2030 and reinstate it at 10000 for 2031.

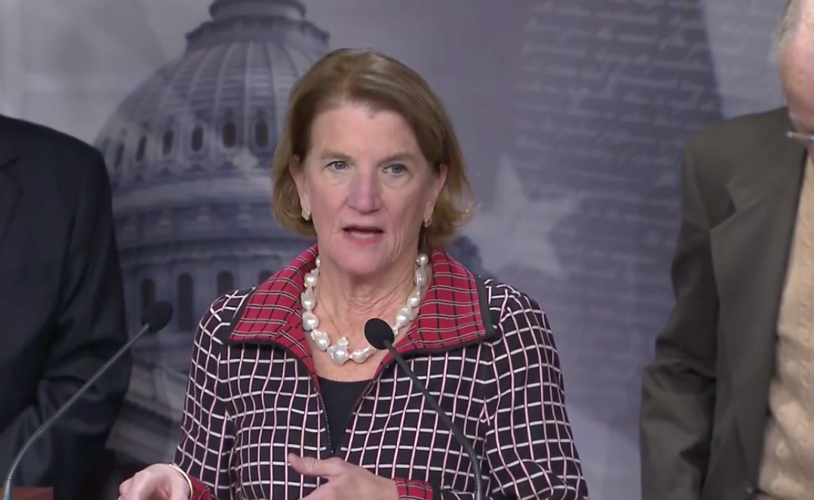

As ITEP explained some Senate Democrats objected and said they preferred a different compromise that would limit relief from the SALT cap for those below a certain income level. SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on or after January 1 2021. December 022021 Senate Republicans Slam SALT Cap Proposal Highlight hypocrisy of providing huge tax cut for the rich.

According to press reports the Senate is considering repealing the 10000 cap on the state and local tax SALT deduction for those making 500000 per year or less. Members from states with higher income tax rates are likely to push to either repeal or modify the cap. Bernie Sanders of Vermont and Bob Menendez of New Jersey are developing a SALT plan that could eliminate the cap entirely for those making 400000 or less and then gradually restore the cap.

That was bad news for top earners in blue states such as California and New York. Even if Congress decides to increase the cap rather than repeal it the change would still be highly regressive. Paying a state income tax of 10 percent or more.

Certain members of the House and Senate want the SALT deduction cap removed which would benefit primarily higher earnersand result in a 380 billion reduction of federal revenue. The provision in question would roll back the 10000 limit on the SALT. Senator Bob Menendez a New Jersey Democrat who is also working on the proposal said the.

Senator Mike Crapo R-Idaho the top Republican of the Senate Finance Committee led a press conference with other Republican Senators to highlight the hypocrisy of Democrats plans to increase the state and. SALT change on ice in the Senate. Nov 19 2021.

The current proposal agreed to in an amendment late last week would increase the cap from 10000 to 80000 through 2030. But the Tax Cuts and Jobs Act limited that deduction to 10000. Democrats who wrongly associate this SALT cap with a tax increase on middle-income folks simply arent looking at the facts or.

Senators Bob Menendez a senior member of the Senate Finance Committee that sets federal tax policy and Cory Booker both D-NJ today introduced the Securing Access to Lower Taxes by ensuring Deductibility Act or SALT Deductibility Act that would repeal the 10000 federal cap on state and local tax. Joe Manchin D-WVa raised broader. Due to the slim Democratic majority in the House and.

November 2 2021. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. Its a blow for Schumer who is up for reelection this year and pledged in 2020 to make repeal of the cap on SALT deductions a top priority if Democrats won control of.

March 1 2022 600 AM 5 min read. Several senators are apparently pursuing revenue neutral state and local tax SALT deduction cap relief meaning the cost of increasing the SALT deduction cap through 2025 would be fully paid for on paper by extending it past its current expiration date of 2026 through 2031. The 10000 limit would then return in 2031.

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to. The new compromise that some Democratic senators are discussing would keep the 80000 cap in the House bill but phase the cap back to 10000 for those with adjusted gross. 54 rows Senate Majority Leader Chuck Schumer D-NY has expressed interest in repealing the SALT cap which was originally imposed as part of the Tax Cuts and Jobs Act TCJA in late 2017.

Democrats have a narrow 221-213 majority in the House and the Senate is evenly split between Democrats and Republicans. Republicans created the 10000 cap on SALT deductions as a means to offset the cost of their other tax cuts in the 2017 Tax Cuts and Jobs Act TCJA. The BBB proposal would have increased the SALT cap to 80000 per taxpayer 40000 for married filing separately and kept this the cap limit in place through 2030.

It was a last-minute tweak. While centrist and right-wing Democrats from high-tax states support lifting the limit Morris warned that repealing the SALT cap would be a colossal mistake. The Tax Foundation estimates according to the Committee for a Responsible Federal.

By Naomi Jagoda - 010922 623 PM ET. The SALT deduction was capped at 10000 under the 2017 Tax Cuts and Jobs Act as a way to pay for massive tax cuts that mostly benefited superrich Americans and corporations. A rollback of the cap on the state and local tax SALT deduction is on ice after Sen.

Sanders has previously floated about 400000 in annual income as the limit for unlimited SALT write-offs. Senate Budget Committee Chairman Bernie Sanders I-Vt on Tuesday fired a warning shot at a five-year repeal of the cap on the state and local tax SALT deduction that Democrats are considering including in their social and climate spending bill. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Senate Democrats Aim To Repeal Rules Blocking Trump Tax Law Workarounds The Hill

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

Tax Policy Center On Twitter New How Does The House S Proposed 80k Salt Cap Compare To The Senate S Proposal To Cutoff Relief At 400k In Income The Impact On The Middle Class

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Moderate Dems Josh Gottheimer And Tom Suozzi Hold Out Hope For Salt Deduction This Year

On The Money No Salt And Maybe No Deal The Hill

Senators Offer Solution As Progressives Warn Salt Repeal Would Be Colossal Mistake

Senators Menendez And Sanders Show The Way Forward On The Salt Cap Itep

Democrats Prepare Plan To Pass Salt Cap Relief Tax Break For Wealthy

Menendez Criticizes Salt Cap Proposal Under Consideration For Spending Bill The Hill

Rep Sherrill Colleagues Union Leaders Call On Senate To Include Salt Relief In Reconciliation Representative Mikie Sherrill

Congress Approves Republican Tax Plan Setting Up Delivery To Trump S Desk The New York Times

The Salt Deduction There S A Baffling Tax Gift To The Wealthy In The Democrats Social Spending Bill The Washington Post

West Virginia U S Sen Capito To Offer Amendment Eliminating Salt Deduction Cap Increase From Build Back Better Bill Wv News Wvnews Com

Salt Deduction Cap Durbin Duckworth Restate Call For Repeal In D C Memo Crain S Chicago Business

Suozzi Pushes For Repeal Of Salt Cap Herald Community Newspapers Www Liherald Com

Major Unions Join The Call To Repeal Salt Cap

Property Tax Breaks Would Be Restored Under Senate Budget Bill Menendez Says Nj Com

Congress Approves Republican Tax Plan Setting Up Delivery To Trump S Desk The New York Times